[10000ダウンロード済み√] 664 credit score auto loan rate 280787-Can i buy a car with 664 credit score

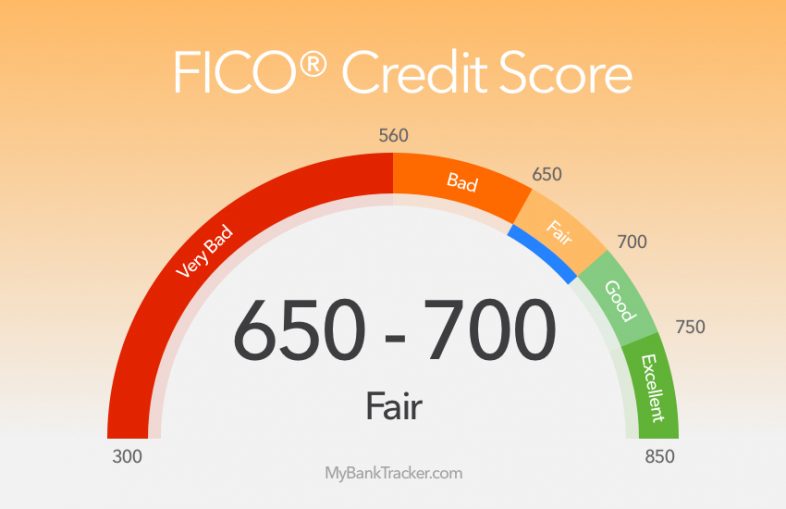

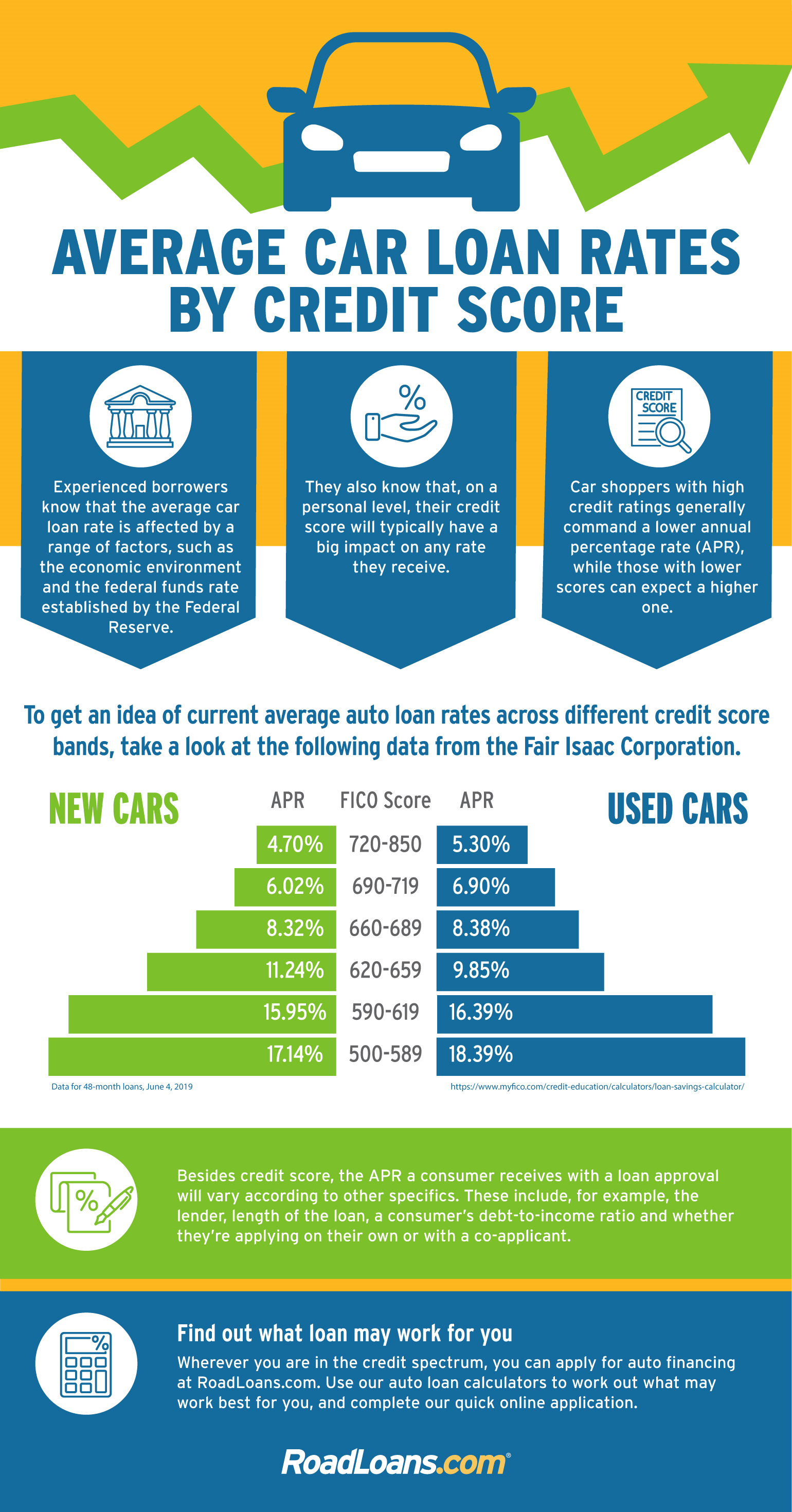

· A score between 6 and 679 is near ideal and a score between 680 and 739 is considered ideal by most automotive dealerships If you have a score above 680, you are likely to receive appealingAll loan payment amounts are based on a used car loan APR interest rate of 118% for subprime borrowers with a credit score of 500 to 599 The loan terms included in this chart are for 3 years (36 months), 5 years (60 months), and 7 years (84 months)Auto Loan Payment Calculator 0 1 1% 1% 1% 0 1 $8000 $8000 $8000 24 mths 36 mths 48 mths 54 mths

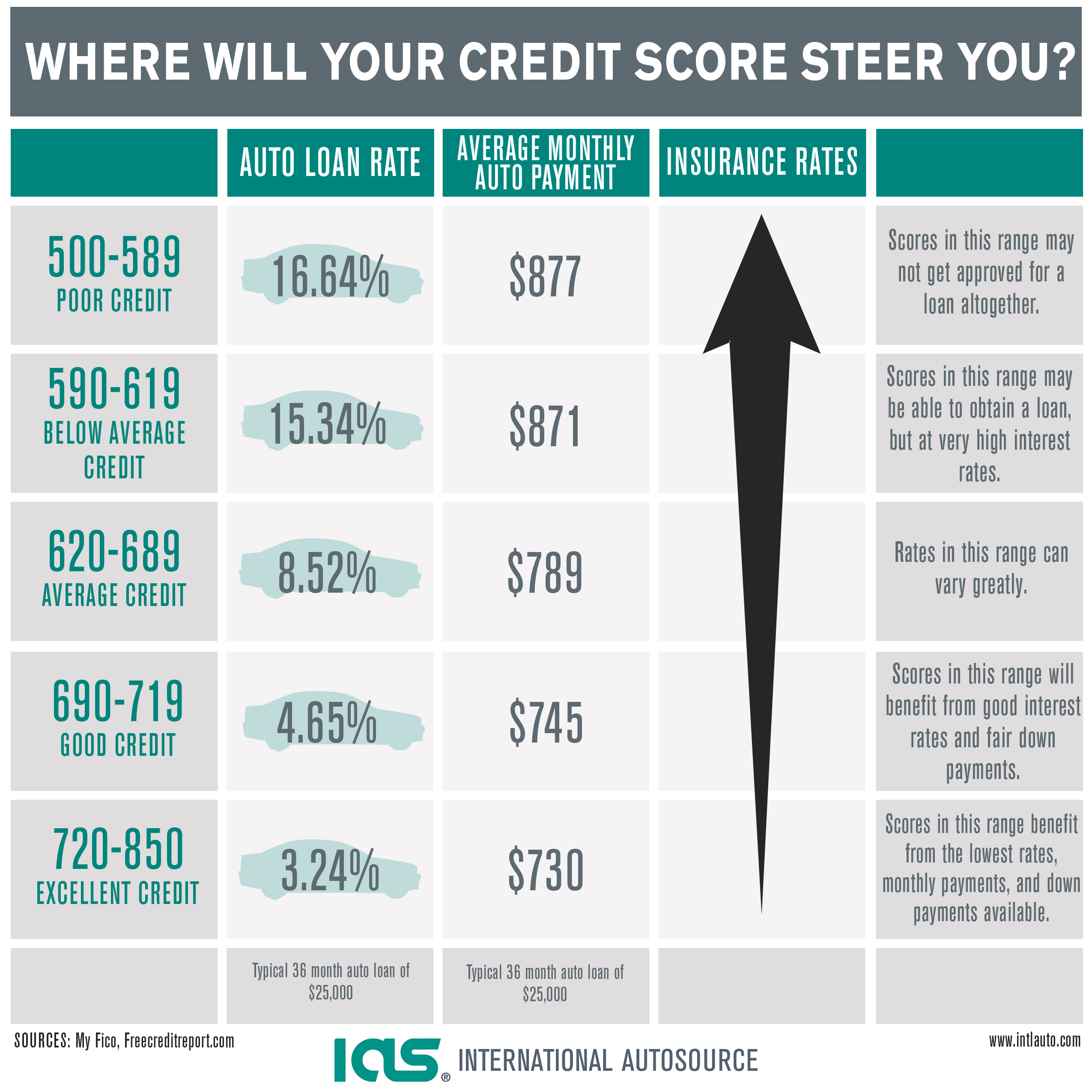

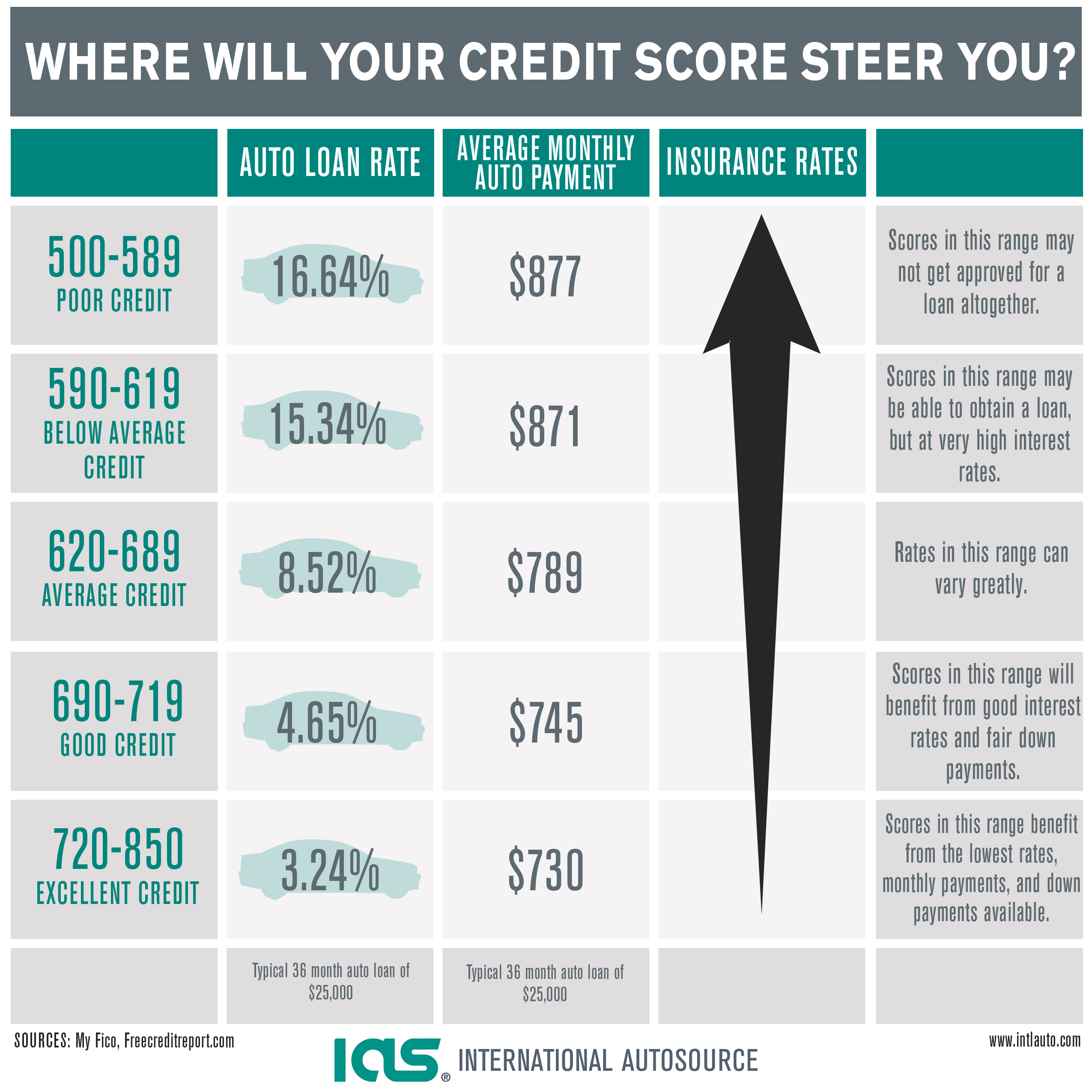

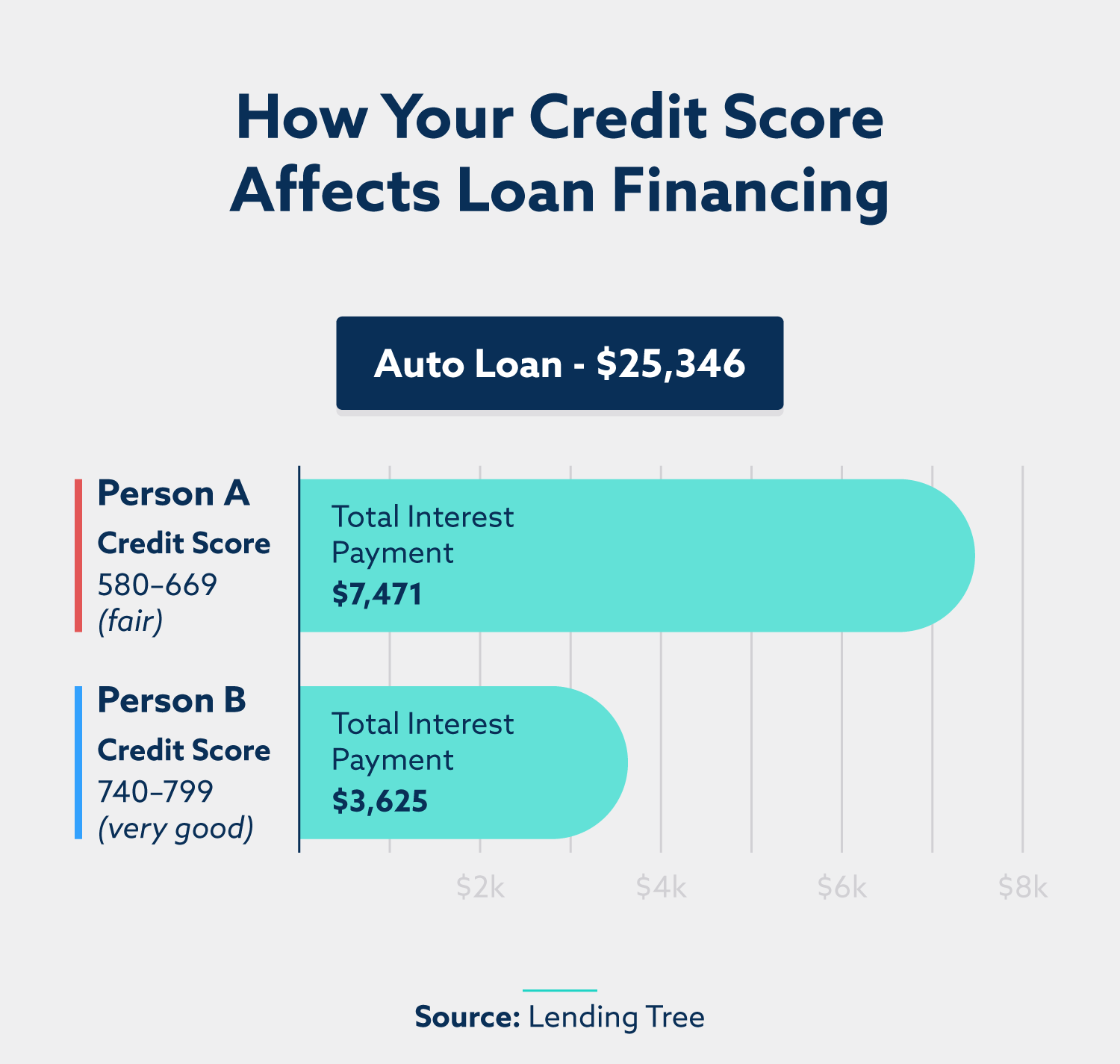

How A Bad Credit Score Affects Your Auto Loan Rate International Autosource

Can i buy a car with 664 credit score

Can i buy a car with 664 credit score- · Your actual rate depends upon credit score, loan amount, loan term, and credit usage and history, and will be agreed upon between you and the lender For example, you could receive a loan of $6,000 with an interest rate of 799%Get Approved For a Bad Credit Car Loan Today While bad credit makes it hard for you to get a car loan, you can still find an instant lowinterest rate auto loan with proper preparations and online research To improve your credit score, you do want to get a car loan and pay it off

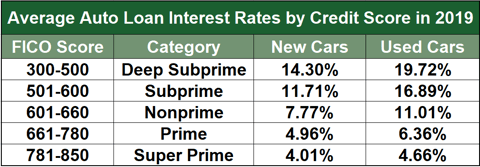

Average Loan Interest Rates Car Home Student Small Business And Personal Loans Valuepenguin

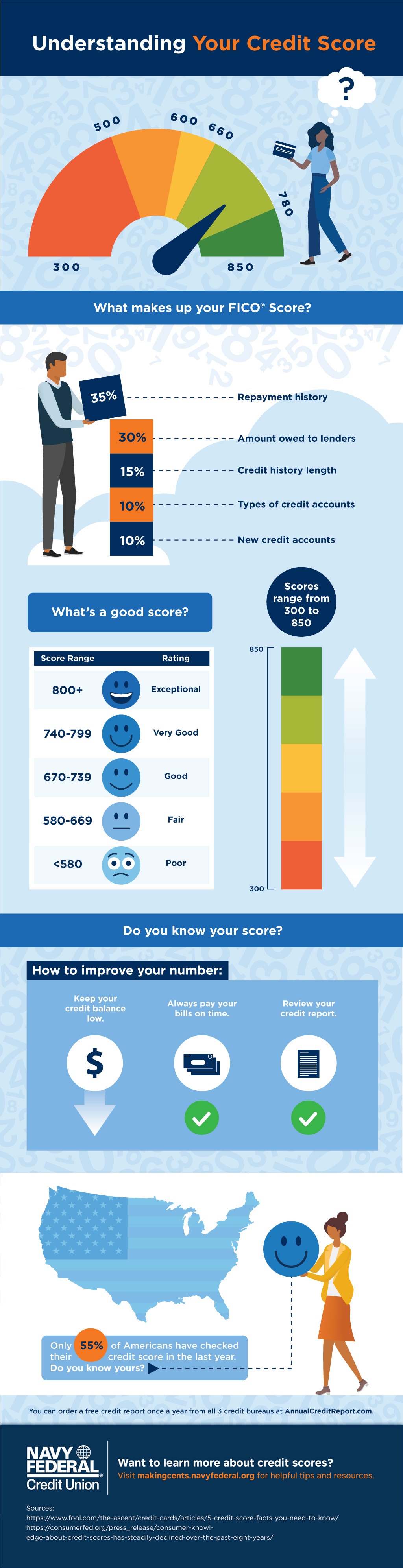

· Navy Federal has the lowest adversided auto loan APR of any of the national lenders we looked at that doesn't require buyers to qualify for it by using another service And that rate could go lower For activeduty and retired military members who utilize direct deposit, Navy Federal offers a 025 percentage point discount, which could bring the starting APR down to 154% · Among consumers with FICO ® credit scores of 664, the average utilization rate is 631% Try to establish a solid credit mix You shouldn't take on debt you don't need, but prudent borrowing that includes a combination of revolving credit and installment debt, can be beneficial to your credit score Learn more about your credit score · Your credit score is a 3digit number that lenders use to estimate how likely you are to repay debt, such as an auto loan or home mortgage A higher score makes it easier to qualify for a loan and can result in a better interest rate Most credit scores range from 300 to 850

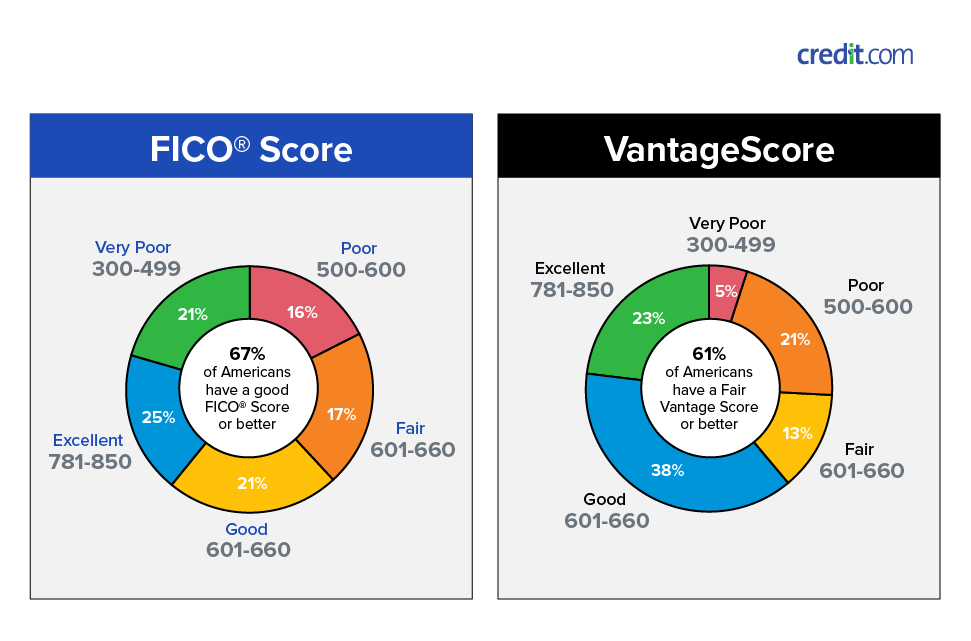

The credit score you receive is based on the VantageScore 30 model and may not be the credit score model used by your lender * Subscription price isWhat auto loan rates are available depending on what your credit score is? · Re expected rate k loan with 650 fico 10k down Hi At my credit union a score of 650 is "B" credit and the lending rate is 425 An "A" rating is 680 and an "A" rating is over 7 Nice thing about credit union is that I went in and talked to someone about a loan, got approval, went to dealership, picked out my 14 sorento, went in to

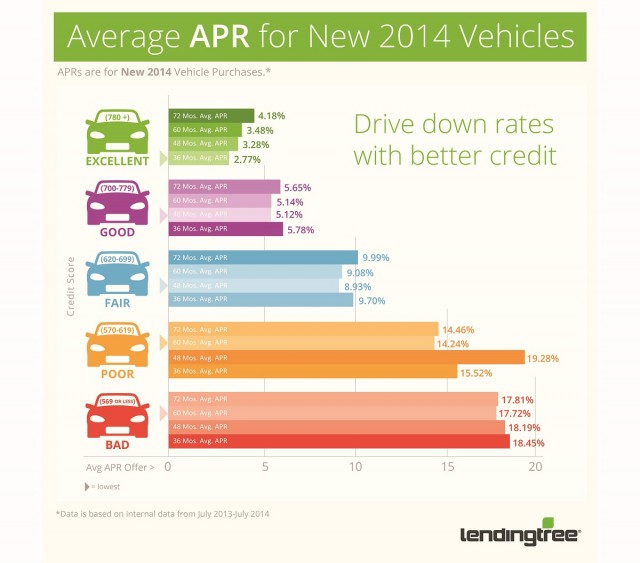

Whether you're in the market for a new or used car, you can expect an auto loan interest rate anywhere between 755% and 955% if your credit scores falls in this range Even though your score is slightly below average, lenders will still few you preferably compared to those with lesser scores · Bad Credit Auto Lenders When you have poor credit, you're likely to have a better chance at an auto loan approval if you're working with a lender that specializes in bad credit lending Typically, if your credit score stands at around 660 or below, you may need to apply with one of these lenders · Credit Score requirements for your auto loan in 19 The average credit score for a newcar loan in 17 was 721 and 641 for a used car loan However, the range of credit scores among people who purchased a car in 17 runs the gamut, so you can still get a loan with a lower than average score — but the terms might not be as great

Lendingtree Auto Loans Reviews What You Need To Know Pros Complaints Review Advisoryhq

What Is An Excellent Credit Score These Days Hbi Blog

Credit Utilization B = 10% 29% utilization;Account Diversity C = 2 account types or 5 9 total accounts; · In the process, the credit score range for FICO Auto Score 8 became 250 to 900 A "good" FICO Auto Score 8 is usually considered to be 700 and above However, there is no universal minimum score needed for auto loans — the decision rests with the auto lender As scores descend below 700, credit approval becomes scarcer and the loan rate

Best Credit Cards For Credit Score 650 699 Average Credit

600 Credit Score Car Loans 21 Badcredit Org

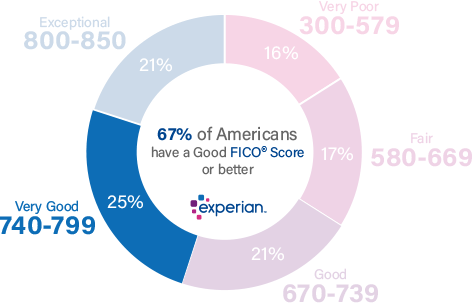

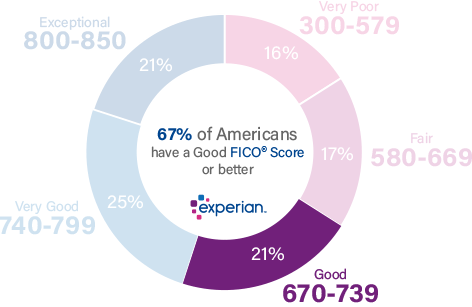

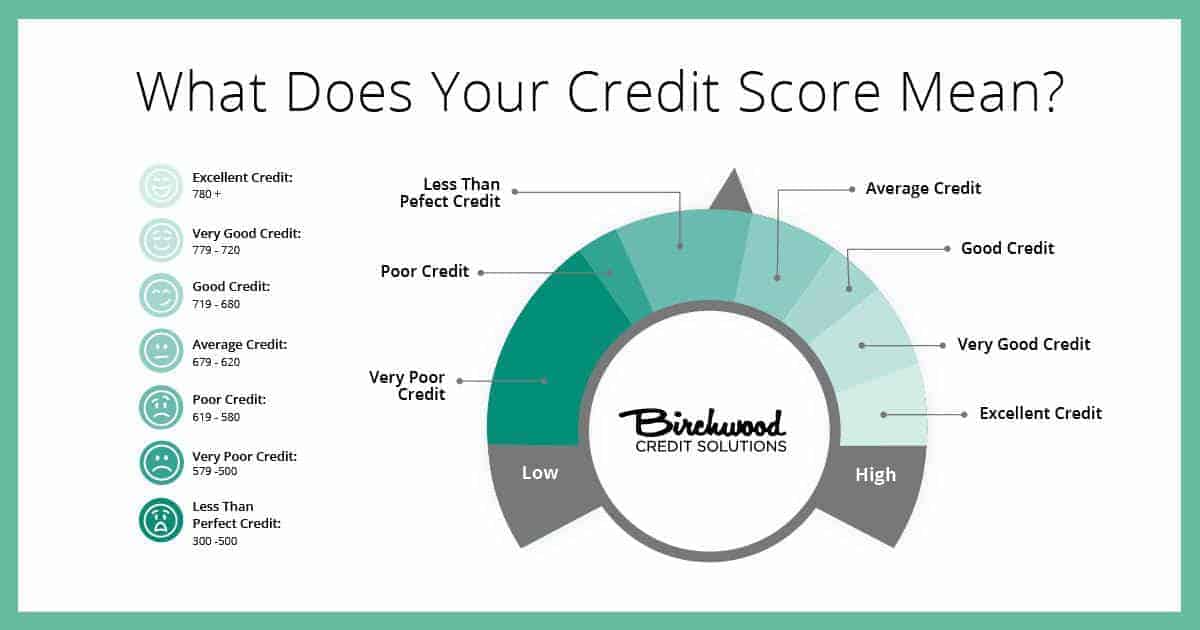

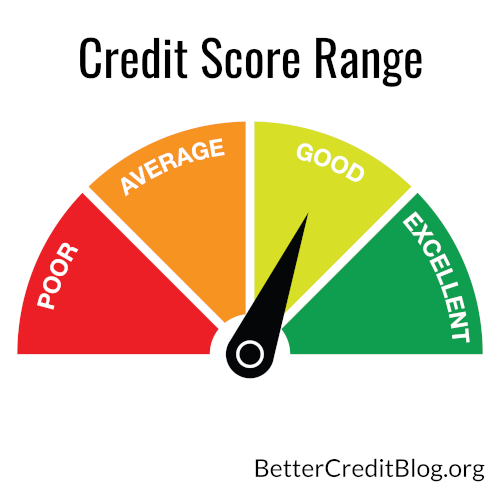

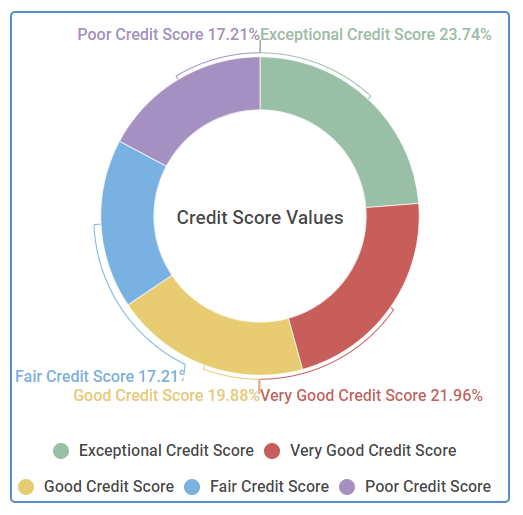

· About 90% of car loan lenders use FICO's auto score, credit expert Gerri Detweiler told Grow last year FICO's auto scores range from 250 to 900, and they specifically reflect your creditworthiness for auto loans The better your auto score, the more likely you are to get a lower interest rate on a car loanHowever if you desire a superb score, you must aim to have a much reduced credit score application rate As we saw from the earlier instance, individuals with an 850 score keep their credit rating application rate as low as 4% Built up Financial debt It's a great suggestion to have a selection of credit report · A 664 credit score is generally a fair score While a lot of people have fair scores, you may still find it difficult to get approved for credit without high fees and interest rates with a score in this range Percentage of generation with 640–699 credit scores Generation Percentage

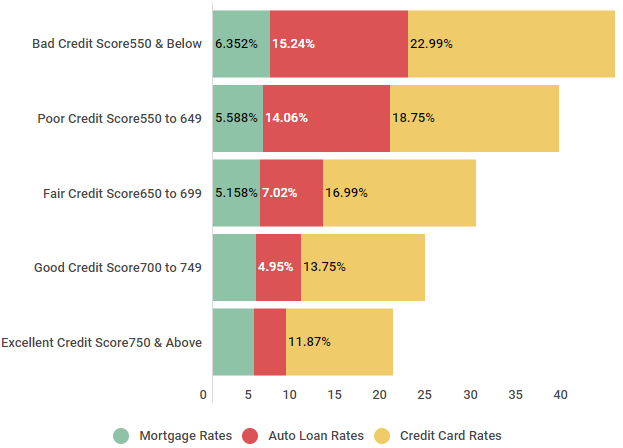

Average Auto Loan Rates Credit Repair

What Is The Meaning Of Your Credit Score Credit Sesame

· Using the average interest rate for people with topnotch credit, 249%, that works out to $1,808 in interest payments People with good and fair credit also have an interest rate of 249% this month At 676%, the average newcar interest rate we found for people with poor credit, the total interest comes to $5,076According to Equifax, at the end of 12, the average national credit score was 696 Poor (Scores ) – Scores in this range indicate that the individual is high risk It may be difficult to obtain loans and if approved, they will be offered higher interest rates Very Poor (Scores 579 500) – Scores in this range are rarely approved · Credit Score Interest Rate 1175% Getting a car loan when your credit is between 600 and 699 can be significantly more expensive than it is for borrowers with better credit scores In fact, the current average interest rate is more than double what it is for prime and superprime credit borrowers

667 Credit Score What Does It Mean Credit Karma

5 Top Credit Cards For Fair Credit Score Of 650 700 Mybanktracker

You will be able to get financed for a used car with a Good or Prime credit score No matter the AVE APR, you may spend less over the course of the loan because used cars tend to cost less than a new car Related RV Financing Financing How to Get A Better FICO Score For A Lower Auto Interest Rate We wrote on getting a 730 credit score car loanHard Credit Inquiries A = Fewer than 3 in past 24 months · 1 Car Price This figure represents the cars sticker price or negotiated price, this is the price that the seller and buyer have agreed upon for purchase of the car This figure does not include sales tax or the cost of financing the loan Enter the

650 Credit Score Auto Loan Interest Rate What Can You Expect Is 650 A Good Credit Score

Auto Lending a Colorado

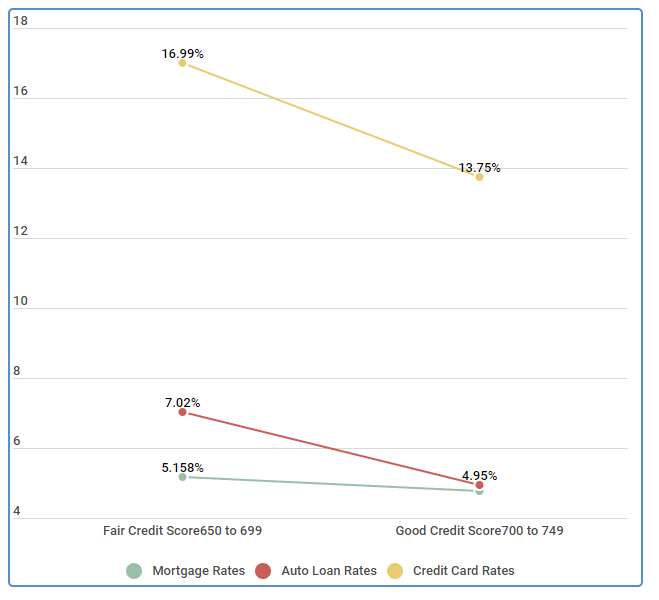

· The typical minimum score for a lease agreement with a reputable dealer is 6 Scores between 6679 are considered near prime by most dealers and are prime Over 740 and you're golden If you're in the higher tiers, you'll most likely be approved, though on the lower end you may incur a higher interest rate to offset the risk · Experian reported that for the fourth quarter of , the average newcar loan rate for scores of at least 661 was only about 1 percentage point higher than the interest rate for scores above 780This is a relatively average credit score range, so an auto loan interest rates with 664 credit score are neither subpar or superb More often than not, the rate will fall somewhere between 621% and 1%, with lower scores resulting in higher interest rates Long gone are the days when people with poor FICO score were not given auto loans

What Are The Different Credit Score Ranges Experian

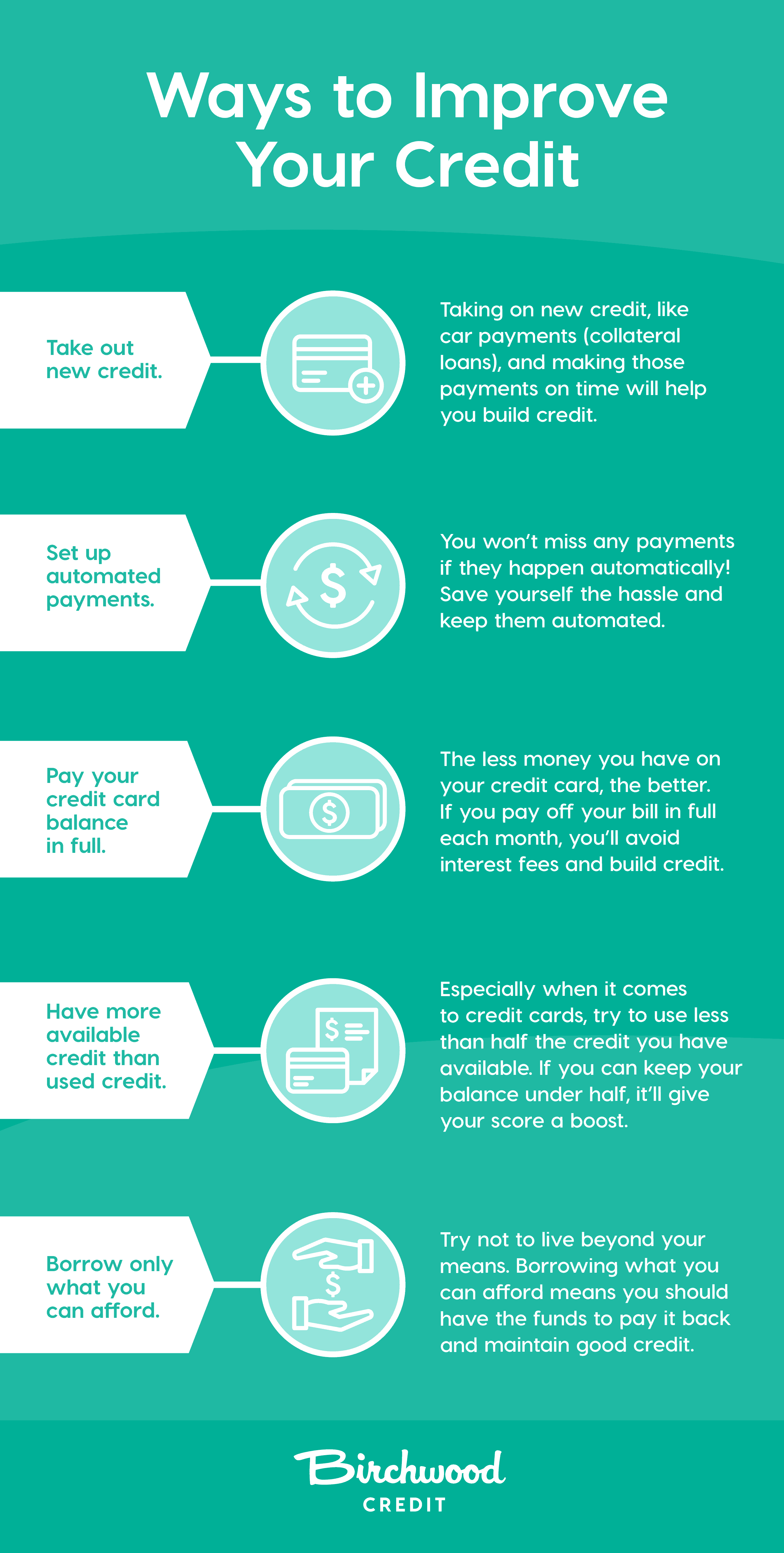

Improve Your Credit Score The Data And Tips You Need To Know

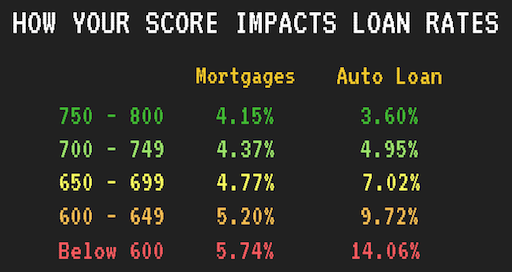

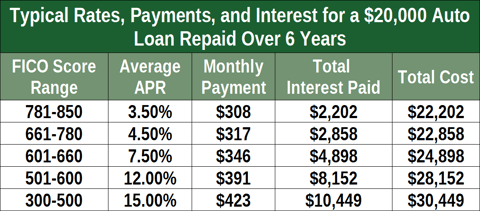

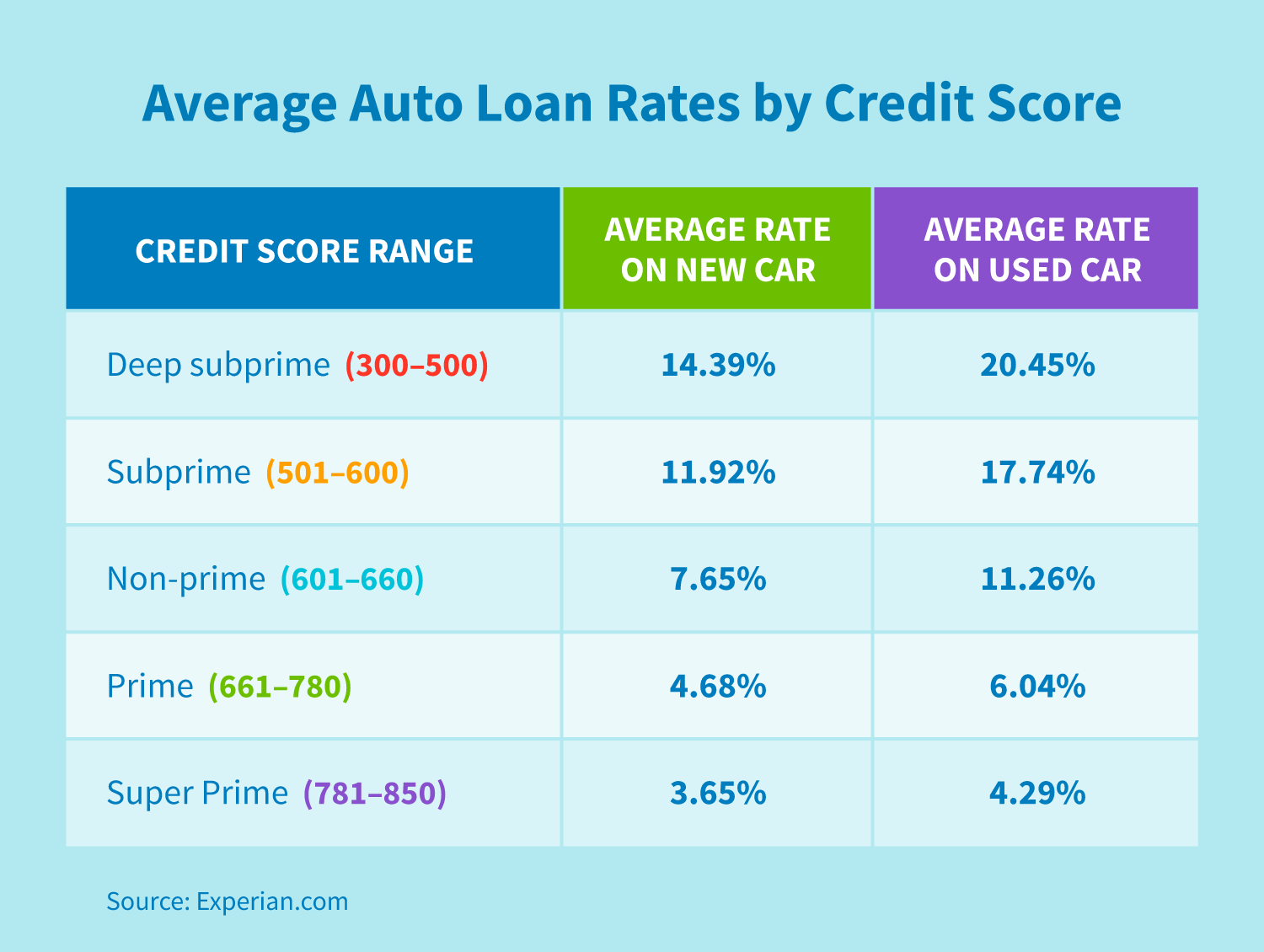

For people with a FICO score between 661 and 780, the average rate is 456% For people with a FICO score between 601 and 660, the average rate is 752% For people with a FICO score between 501 and 600, the average rate is 11% For people with a FICO score between 300 and 500, the average rate is 1441% Source NerdWallet, 3/1/19 · Having a credit score of about 660 to 6 is considered a favorable credit score for car loans This will yield a traditional car loan with average interest rates For a car loan of $10, and a credit score in this range will give you an annual percentage rate of 43% or a monthly payment of about $ for a 36 month period or $700According to a Federally funded study on used auto loans, people with a credit score of 664 and 665 were likely to save over $4,000 as compared to a 'nonprime' borrower

Your Credit Score Your Auto Loan 4 Things You Can Do To Get A Better Interest Rate

How And Why To Refinance Your Auto Loan

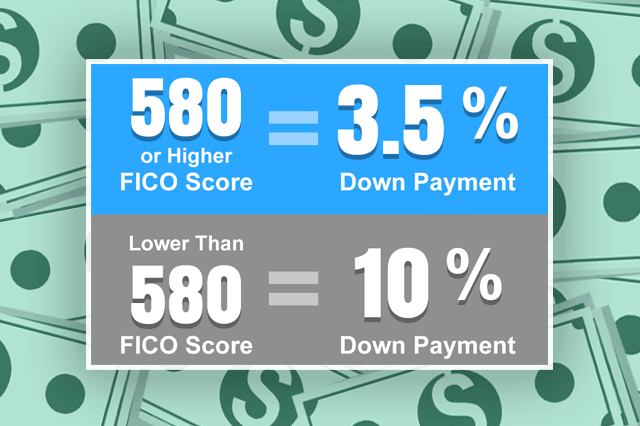

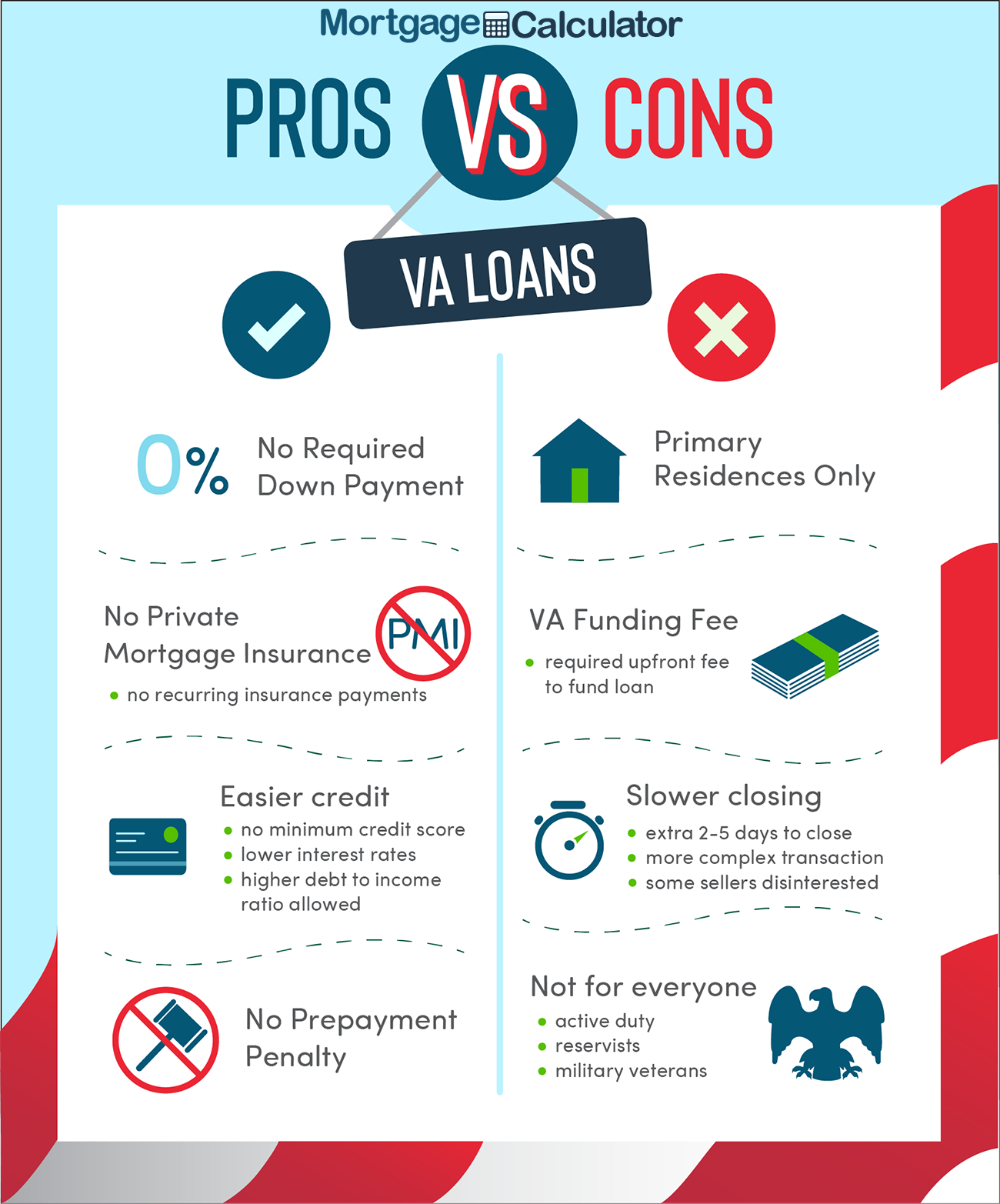

FHA Loan with 664 Credit Score FHA loans only require that you have a 580 credit score, so with a 664 FICO, you can definitely meet the credit score requirements With a 664 credit score, you should also be offered a better interest rate than with a FICO score · A target credit score of 660 or above should get you a car loan with an interest rate around 6% or below That data comes from a June report from credit bureau Experian · Prime borrowers with a credit score between 661 and 780 received an average APR of 421% for new loans and 605% for used loans, while nonprime borrowers with credit scores between 601 and 660

Best Auto Loan Rates With A Credit Score Of 660 To 669 Credit Knocks

Best Auto Loan Rates With A Credit Score Of 660 To 669 Credit Knocks

Low scores create capped amounts and durations For example, a buyer with a 750 FICO score may qualify for $ at 96 months, but a 650 score may be maxed out at $ for 72 months Set your credit score, then move the other squares in the car loan calculator to find the maximum loan and term for your FICO scoreSample Scorecard – 664 Credit Score Payment History C = 98% ontime payments; · Experian's quarterly State of the Automotive Finance Market takes a look at the average auto loan interest rate paid by borrowers whose scores are in various credit score ranges As of the first quarter of , borrowers with the highest credit scores were, on average, nabbing interest rates on new cars below 4%

Maine Gov Pfr Consumercredit Documents Auto guide 17 05 Pdf

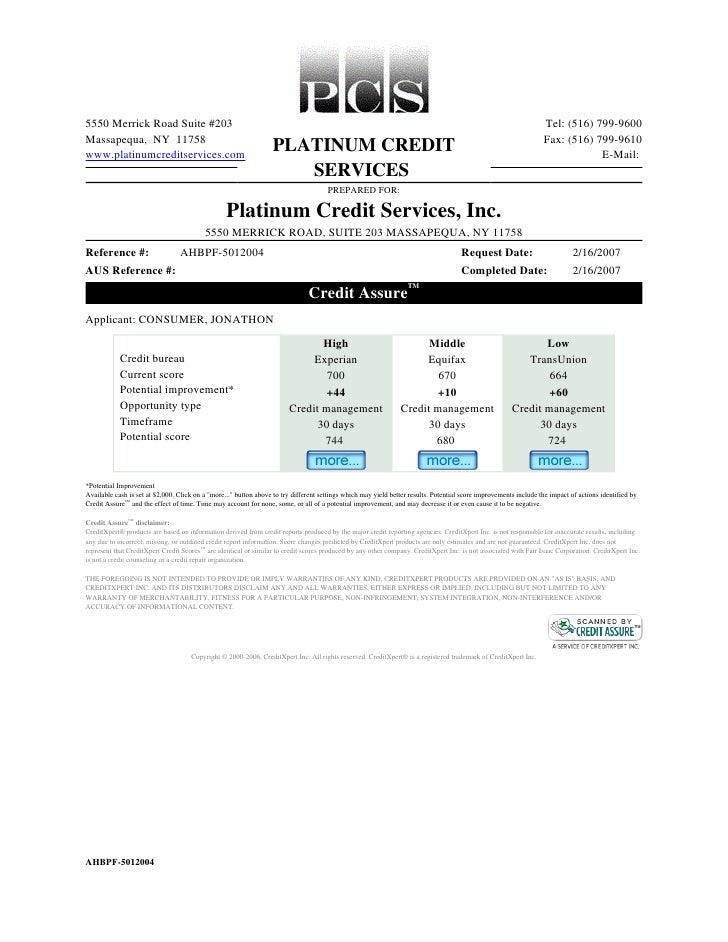

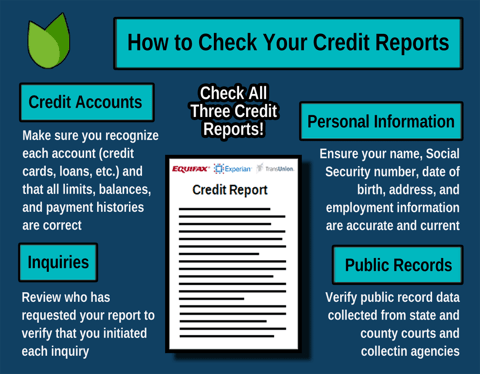

Pcs Credit Report

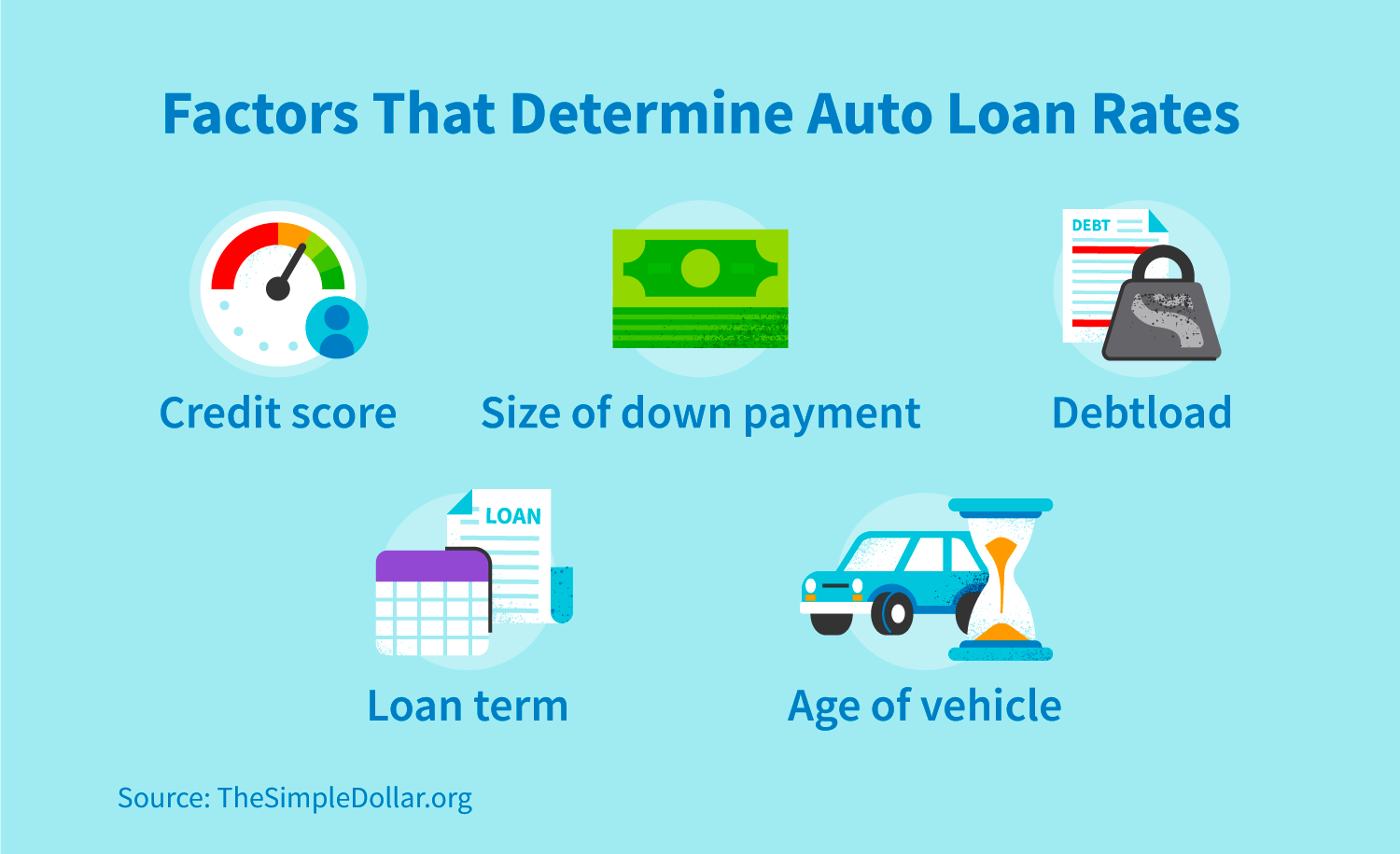

Generally speaking, banks require a minimum credit score of 600 to give an auto loan without any down payment However, you CAN buy a car with a score of 400 or a score of 850 There are a lot of variables that weigh into determining your loan eligibility and interest rates availableDebt Load A = Debttoincome ratio below 028; · A 650 credit score auto loan interest rate will vary pending on your lender, your downpayment, your DTI, and the loan terms The longer your terms of the loan (36 to 60 months) the higher your rates The commercials you see with low APR percentage rates are for attention grabbers and is most likely possible for borrowers with 750 or higher

Your Credit Score Mortgage Miracles Happen Ben Gerritsen Team

A Complete Guide To Finding Your True Fico Credit Score Free Report

· Credit score, whether the car is new or used, and loan term largely determine interest rates The average rate dropped since the first quarter ofTo purchase a new car, the average credit score needed is 715 with an average auto loan rate of 576 percent, according to an Experian report For those buying a used car, the average credit score is 662, with an average auto loan rate of 949 percent The average auto loan rates by credit score for a new car Deep subprime (300–500) 1439%Account Age B = Average tradeline is 7 or 8 years old;

Average Auto Loan Interest Rates Facts Figures Valuepenguin

America S Personal Loans Visualized Income Principal And Credit Scores The Business Of Business

The interest rate on the car loan with your credit score is %, your monthly payment will be $ The total paid amount will be $ However, when you increase your credit by 50 points, the APR will be lower This is because people withPočet řádků 6 · Individuals with a 664 FICO credit score pay a normal 676% interest rate for a 60month new · This is the range when you start to look for the perks that a card offers Here are the factors we consider most important in this credit score range Annual Percentage Rate (APR) In this credit score range, you start to see lower interest rates on credit cards A card may offer 1499% to 2499% Annual fee

3 Reasons You Should Work To Raise Your Credit Score In 19

Blog Post Rogue Credit Union

/05/ · Mortgage rates for credit score 664 on Lender411 for 30year fixedrate mortgages are at 299% That increased from 299% to 299% The 15year fixed rates are now at 256% The 5/1 ARM mortgage for 664 FICO is now at 456%Check to see what interest rate you might pay if your credit score is good If your credit score is bad, see what car loan rate you might end up paying · This chart, based on APRs for closed auto loans by credit score on the LendingTree loan platform in , illustrates how your credit score can affect what you pay to finance your car Credit Score Average APR 7 or higher 549% 680–719 721% 660–679 1007%

Fha Credit And Your Fha Loan In 21

Best Auto Loan Rates With A Credit Score Of 660 To 669 Credit Knocks

A 664 credit score is not super low, but not really high either A 664 credit score is a fair credit score No, 664 is not a bad credit score 664 is a fair credit score Someone with a credit score of 664 will probably be able to get a loan, but pay higher interest and with worse terms compared to someone with a higher credit score · Credit inquiries related to auto loans made within a short time frame (usually 14 days, or 45 days depending on the credit score model being used) are supposed to count as a single inquiry However, some of our readers have found their credit scores dropping after multiple car dealers sent credit inquiries for financingTrying to qualify for an auto loan with a 664 credit score is expensive There's too much risk for a car lender without charging very high interest rates Even if you could take out an auto loan with a 664 credit score, you probably don't want to with such high interest There is good news though

Maine Gov Pfr Consumercredit Documents Auto guide 17 05 Pdf

Auto Loan Approvals Myfico Forums

The Credit Score Used For A Car Loan It S Not What You Think

1

Credit Score Range What Is The Credit Score Range In Canada

742 Credit Score Is It Good Or Bad

It S A Small Win But A Win Nonetheless I Finally Got My Credit Score Into The 700 S Povertyfinance

650 Credit Score Auto Loan Interest Rate What Can You Expect Is 650 A Good Credit Score

How To Get Out Of A Car Loan Wealthfit

600 Credit Score Car Loans 21 Badcredit Org

Auto Loan Approvals Myfico Forums

Dnhg0fkecrholm

Should You Get An Auto Loan Or Pay Cash Pros And Cons Money Girl

I Am 19 And Have A Credit Score Of 715 Can I Get A Car Loan For k Quora

1

What Credit Score Do You Need To Buy A Car Nerdwallet

Best Auto Loan Rates With A Credit Score Of 660 To 669 Credit Knocks

Credit Info The Big Score Credit Education And Repair

Best Auto Loan Rates With A Credit Score Of 660 To 669 Credit Knocks

What Is A Good Credit Score To Buy A Car Most Borrowers Are Above 660

Credit Scoring B2 Funding

Tips For Financing A Car With Bad Credit Volkswagen Of Alamo Heights

614 Credit Score Good Or Bad Auto Loan Credit Card Options Guide

Fico Score Help Please Very Detailed Myfico Forums

How A Bad Credit Score Affects Your Auto Loan Rate International Autosource

Best Auto Loan Rates With A Credit Score Of 660 To 669 Credit Knocks

Lower Your Rate Now The Car Loan Market Is Inefficient

How To Get Out Of A Car Loan Wealthfit

600 Credit Score Car Loans 21 Badcredit Org

Check Out Average Auto Loan Rates According To Credit Score Roadloans

Pin On Car Ownership

Best Auto Loan Rates With A Credit Score Of 660 To 669 Credit Knocks

Our Fico Credit Score Range Guide Credit Score Chart

691 Credit Score Is It Good Or Bad

What Is A Good Credit Score Credit Com

3

8 Best Loans Credit Cards 650 To 700 Credit Score 21

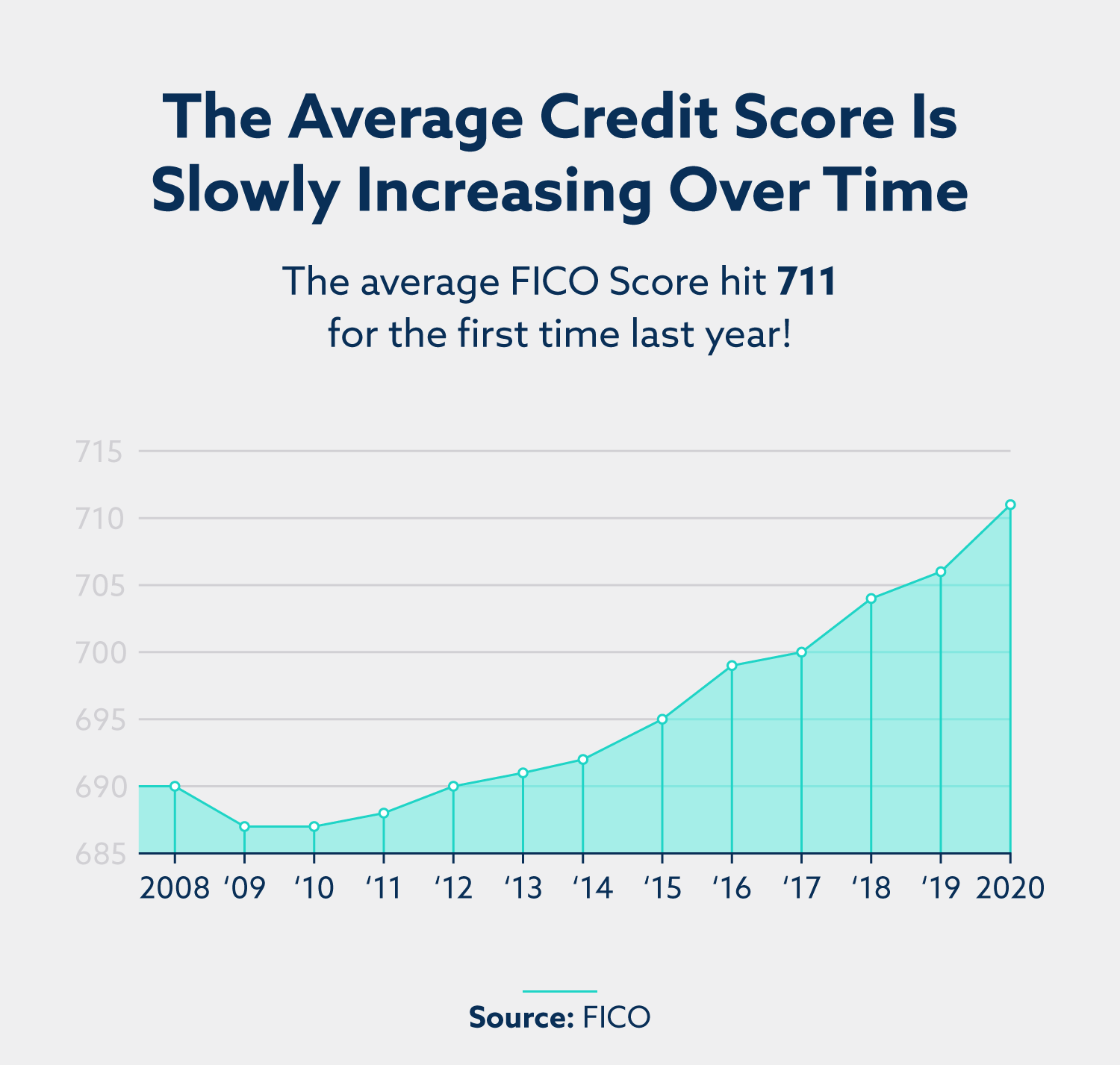

What Is The Average Credit Score In America Average Credit Scores By Age State Year More

1

664 Credit Score Good Or Bad Auto Loan Credit Card Options Guide

Seven Things To Know About Car Loan Credit Reports Edmunds

Credit Score Range What Is The Credit Score Range In Canada

664 Credit Score Is It Good Or Bad What Does It Mean In 21

How To Get Your Credit Score Above 700 Credit Sesame

Boat Loans With A 664 Credit Score Creditscorepro Net

How To Understand Your Credit Score Faqs

Our Fico Credit Score Range Guide Credit Score Chart

Credit Scoring B2 Funding

30 Credit Score Statistics For 21 Lexington Law

Your Post Bankruptcy Credit Score

30 Credit Score Statistics For 21 Lexington Law

Lower Your Rate Now The Car Loan Market Is Inefficient

Places Where Credit Scores Have Risen The Fastest Smartasset

Auto Loan Rates By Credit Score Experian

Our Fico Credit Score Range Guide Credit Score Chart

Average Auto Loan Rates Credit Repair

Average Loan Interest Rates Car Home Student Small Business And Personal Loans Valuepenguin

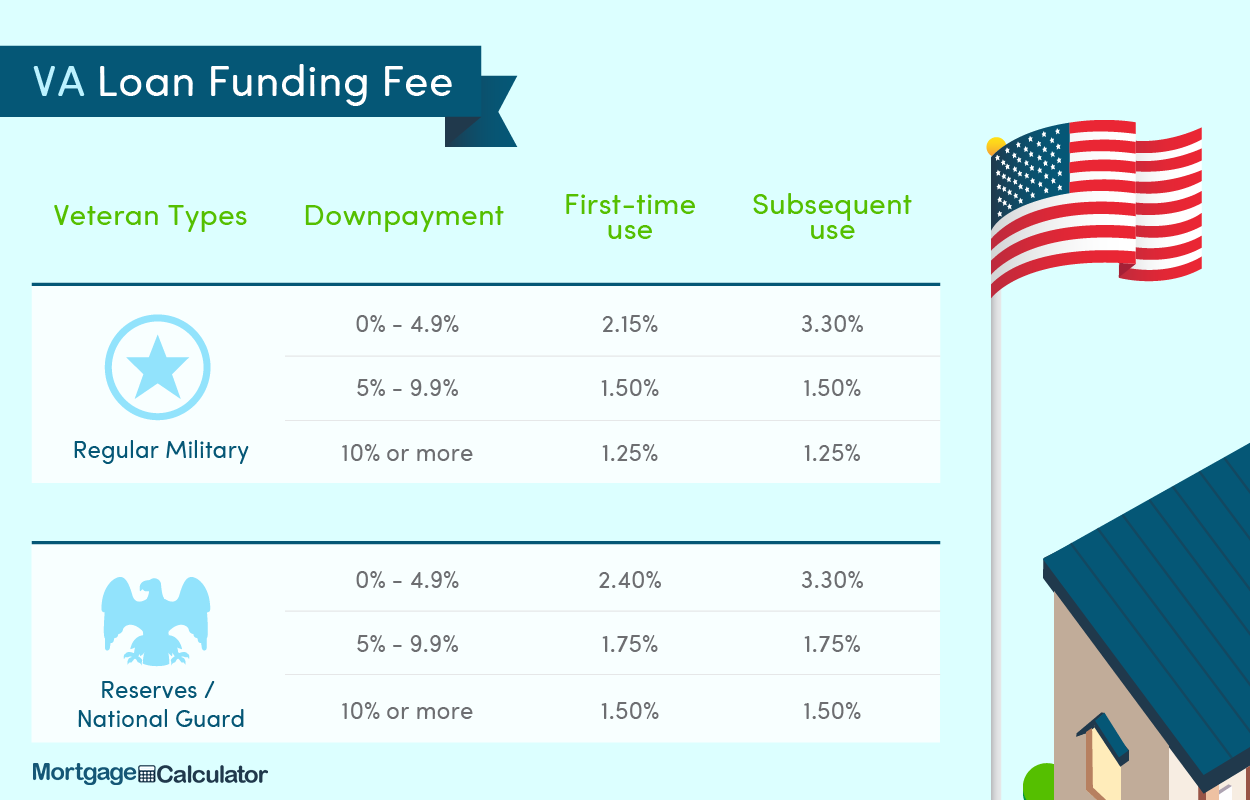

Va Home Loan Rates Guidelines Eligibility Requirement For Va Loans Lock In Low Mortgage Rates

All About Credit Scores cu

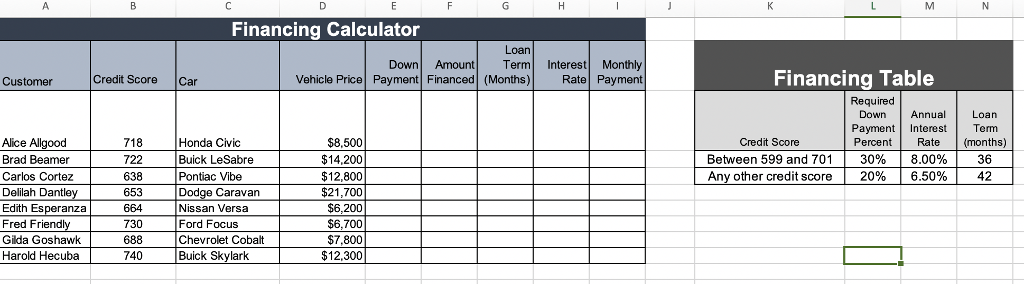

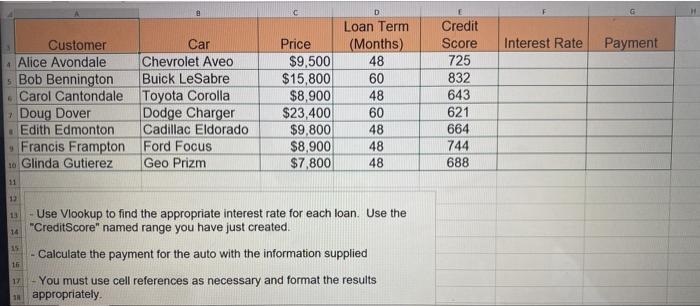

Financing Calculator Loan Down Amountterinterest Chegg Com

Best Credit Cards For Credit Score 650 699 Average Credit

Everything You Need To Know About Credit Scores Makingcents Navy Federal Credit Union

How To Get Your Credit Score Above 700 Credit Sesame

Consumer Loans Greater Cleveland Community Credit Union

664 Credit Score Good Or Bad Auto Loan Credit Card Options Guide

664 Credit Score Is It Good Or Bad What Does It Mean In 21

Qod What Is The Interest Rate Differential On Car Loans Between Those With Bad Credit And Those With Best Credit Blog

Does It Matter Where You Live Average Credit Scores By State Blue Water Credit

Just How Bad Is My Bad Credit Score Credit Com

Va Home Loan Rates Guidelines Eligibility Requirement For Va Loans Lock In Low Mortgage Rates

What Credit Score Do You Need To Buy A Car Nerdwallet

Refinancing Loans Wesbanco

What Credit Score Do You Need To Buy A Car

Car Loan Interest Rates With 664 Credit Score In 21

Interest Rate Payment Customer Car Alice Avondale Chegg Com

44 Credit Score Statistics 21 Data By Age Gender Generation Comparecamp Com

/Balance_The_Fico_8_Credit_Scoring_Formula-1203b3ec26b34cc4aa2eddbee3a8bdb1.png)

Fico 8 Credit Score What Is It

:max_bytes(150000):strip_icc()/dotdash_Final_What_Credit_Score_Should_You_Have_May_2020-01-835d268d06fb4abd9a63033d40b5e9f7.jpg)

What Credit Score Should You Have

コメント

コメントを投稿